The election has been on everyone’s lips. One question that we are regularly asked is: Why do house prices in Harrogate continue to climb, despite the uncertainty surrounding the government’s future plans?

Our answer? It is largely due to availability of low cost money and the knock on effect in the market place of reduced monthly mortgage payments.

Basically, lenders are now happy to lend to applicants without huge savings. This means that a good number of renters in town are becoming first time buyers (or FTBs) because it can sometimes be more affordable to buy than rent. FTBs drive all the house markets in the UK and naturally this is also true in Harrogate.

There are some very good mortgage deals available out there and taken together with “Help to Buy” (HTB) and “Right to Buy” schemes, there’s a reduction in the cost of deposits and monthly repayments.

For example – a new HSBC mortgage comes with a rate of just 1.99% and fixed for 5 years (albeit with 40 % deposit and a fee of £1,499 ).

However FTBs with a 5% deposit can take a fixed rate just over 4% and if they can raise a 10% deposit the rates are as low as 2.69%.

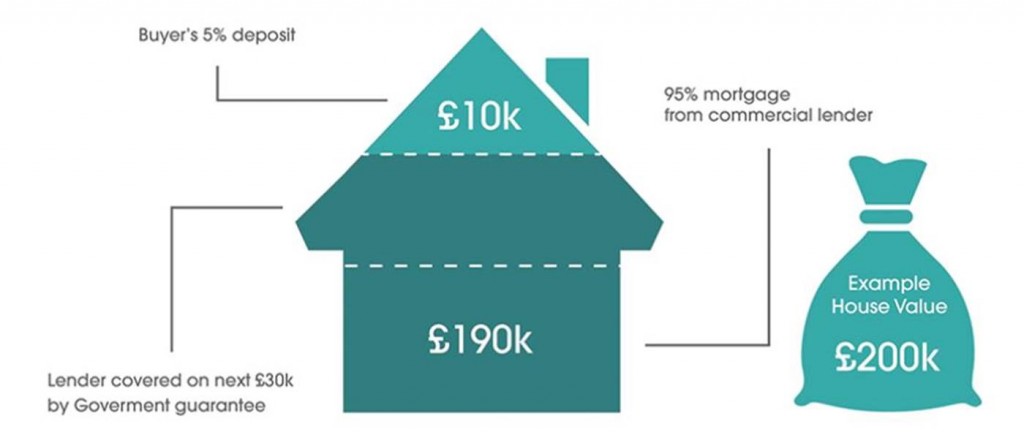

It’s also fair to say that a good number of potential buyers in our offices still don’t fully appreciate the financial advantages of the reforms in the “Help to Buy” schemes.

Here’s an illustration of the basic model:

Source: http://www.helptobuy.org.uk/equity-loan/equity-loans

The HTB schemes are available for FTBs and also existing homeowners up to value of £600,000. They are available on established as well as new build properties.

In summary, the iron rules of the market place always apply, as they do to property and anything else: Any increase in the number of potential buyers with cash or “ Mortgage Ready” finances, coupled to a limited supply always drives up prices.

If you’re thinking of selling, buying, letting or renting property locally and require bang up to date information about the local property marketplace, Myrings are happy to provide you with everything you need. Please feel free to contact our office, open seven days a week.