These are some of my reflections on renting as I gaze from my study window at the top of the house across the sweeping grasslands and woods of ‘Gods own Country’.

These are some of my reflections on renting as I gaze from my study window at the top of the house across the sweeping grasslands and woods of ‘Gods own Country’.

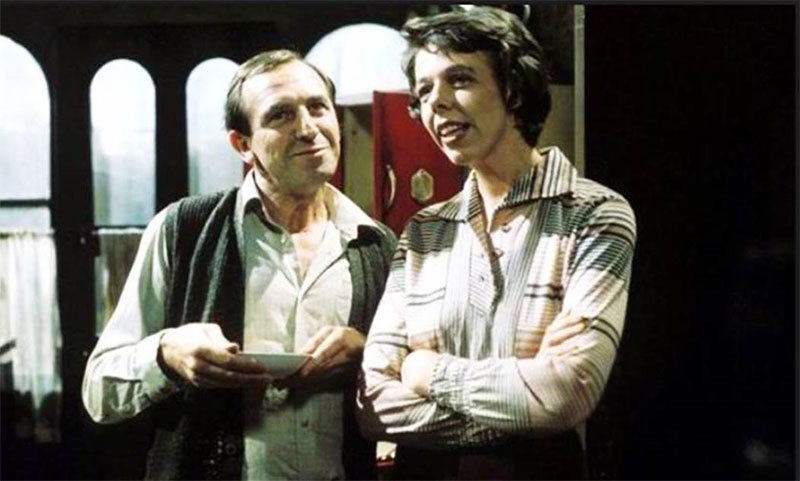

Renting was rather unfashionable back in the 60’s & 70’s and youngsters either lived in a Rigsby ‘Rising Damp’ style bedsit with woodchip wallpaper and a coin operated electric meter or at home with their parents. Young folk got engaged to be married and saved hard for a couple of years to fund a deposit on a new home. The universal perceived logic back then was that paying rent was ‘wasted money’ and home ownership everything.

The ‘Bank of Mum & Dad’ was unheard of at this time for the simple reason that Mum & Dad had no spare cash but they would also save hard to buy a three piece suite or a dining room table and four chairs to help the newlyweds set up home.

Let us now leap forward 50 years. Home ownership is still everything but renting nowadays is a lifestyle choice in the UK as well as a means to allow people to work and save for a deposit to buy a property. Renting is no longer the main preserve of amateur landlords, youngsters and students but of a huge constituency with different agendas and needs. In some urban areas now one third of us are tenants and just two thirds of us are owner occupiers with the numbers declining.

So what did actually change in Britain?

Renting is no longer seen as unfashionable and has become instead a huge part of the property marketplace as the costs of home ownership have increased year on year as wages stalled. The big increase in house prices has been being driven in some part by the expansion of the PRS (The Private Rental Sector) and fuelled by the emergence of large numbers of BTL (Buy to Let) investors.

Let’s take a closer look at the rental constituency, but leave on one side the place in the marketplace of Local Authority (Council) Housing/Housing Associations and just concentrate on the nature/role of the PRS.

A massive house building program is at the heart of current Government policy but the sad fact is that we are building far few homes for an expanding population and that many potential buyers haven’t got a big deposit nor the means to pay the mortgage on a new home. A great many folk have no alternative but to rent and save. Recent initiatives such as ‘Help to Buy’ are helping but controversial recent ‘reforms’ on SDLT (Stamp Duty) and taxation for BTL investors in the PRS sector can be seen as counterproductive given that some landlords are selling up and exiting the market. The iron rules of economics, ‘supply & demand’ always apply. Any shortage of rental properties in the PRS will drive up rents.

Being an investor/landlord is no longer a hobby, it’s a business! Even for a significant number of ‘accidental’ landlords (for example – newly married couples renting out one of their homes prior to selling one or both and in time buying something new together).

What about the Bank of Mum and Dad?

This bank has become, for many millennials, the principle route into home ownership. A report by Legal and General has predicted that parents will lend more than £6.5bn this year to help their children buy a home, a 30% increase on last year. All in all, this bank is expected to underpin the purchase of £75bn worth of property in 2017.

What are the key/basic financial benefits of renting nowadays? In brief;

- Renting allows you to move as many times as needed before settling down.

- As a tenant, it’s the landlord (not you) who is the one that will pay all the bills for maintenance and repairs.

- You can establish or repair your credit history by renting a property and paying the rent in full & on time.

- Opportunity to save & invest the money that you would have had to use as a down payment on a house.

Summary from a Harrogate perspective.

Ah – Harrogate again – where we are living the dream.

The Rental market here is robust and strong with demand in many locations for large family houses in good school catchment areas exceeding supply.

Our landlords view with concern but with equanimity the changes in Stamp Duty rates and Tax breaks on the basis that rents in the town are strong and capital growth pretty much assured over time (but not of course guaranteed).

BTL is still a great investment option for most people in Harrogate. In fact our view is that there has seldom been a better time to buy BTL property than now, but as we always say you must buy wisely. Gone are the days of the amateur investor/landlord when you could make profit on anything with four walls and a roof. Take good advice and do your homework.

You must never forget – the most value in any investment is almost always in the buying – buy right and rent right to good tenants and make sure you find yourself a really good Sales & Letting Agent – I recommend Myrings!!!!!

If you wish to discuss the above or are interested in the Property market in Harrogate then please come along and see us and enjoy a free no obligation chat about the services we provide or contact us on 01423 566400.