It will come as no surprise to anyone that the Chancellors announcement of a temporary Stamp Duty ( SDLT) holiday on the 9 th of July has triggered both a big surge in new listings & sales but also in queries & questions. We would stress that we are not Property Lawyers or Taxation specialists but will do our best to broadly set out the new landscape and clarify a number of issues.

Firstly – if you’re buying your main property up until 31st March 2021, you will not have to pay Stamp Duty on properties costing up to £500,000. This will apply whether you’re a FTB ( First-Time Buyer) or have previously owned a property.

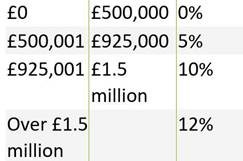

New Rates.

This tax applies to both freehold and leasehold properties – whether you’re buying outright or with a mortgage.

Secondly you must complete your property purchase by 31 March 2021 to qualify for the new revised rates. Any purchases completed before the Chancellor’s announcement on 8thJuly 2020 will continue to pay the Stamp Duty rates valid at that time.

Naturally the new regime impacts differently in different parts of the property marketplace – for example.

Second home buyers and BTL(Buy-To-Let) Investors.

Buyers now will only pay 3% on the first £500,000 of a property’s price.

Previously, second home Buyers would pay 3% on the first £125,000, after that they were charged 5% on the next £125,001 to £250,000, with the rates increasing as property values increased.

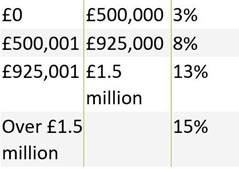

New Rates.

The tax rates for the bands between £925,000 to £1.5m and over £1.5m have not changed.

If you buy a new main residence but there’s a delay in selling your previous main residence, you’ll have to pay the higher Stamp Duty rates as you’ll now own two properties. However, if you sell or give away your previous main home within 3 years of buying your new home you can apply for a refund of the higher SDLT rate part of your Stamp Duty bill.

There are other circumstances in which Stamp Duty is either not payable or can be reduced – for example:

- Transfer of property in separation or divorce. If you’re divorcing or separating from your spouse or partner, there’s no Stamp Duty to pay if you transfer a proportion of your home’s value to them.

- Transfer of deeds. If you transfer the deeds of your home to someone else – either as a gift or in your will – they won’t have to pay Stamp Duty on the market value of the property.

Finally , there is nothing new about Stamp Duty holidays – we have had two in modern times – and the financial gurus are still years later debating whether or not they were a big success. Some think it would have been better for the Treasury to indemnify 15 % of the loans to house Buyers with the Lenders so that hard pressed FTB’s and “ Second Steppers “ could qualify for / afford lower cost 85% mortgages.

For our part we think with good evidence that the new initiatives will be very good news for all parties in Harrogate and help the rebounding of our local economy. We have never been so busy on new instructions and successful sales in well over twenty years !!!!!!!!

If you wish to discuss the above then please contact us for a free no obligation chat about the Harrogate property marketplace and all the property services we provide.

Charles.